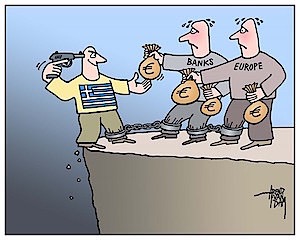

Het zal me benieuwen hoe het met Griekenland afloopt. Duidelijk is wel dat het IMF met twee maten meet wat het ‘redden’ van landen betreft. In de eerste plaats kun je beter niet ‘gered’ worden door het IMF, want ze eisen volledige overgave, privatisering (tegen dumpingprijzen) van zowat alle nationale ondernemingen en zware bezuinigingen op bijvoorbeeld pensioenen. En ten tweede is er onder de strenge normen van IMF, ECB en EU geen toekomst voor Griekenland. Het IMF houdt zich ook niet aan zijn eigen regels waar het een niet EU-land als Oekraïne betreft.

WashingtonsBlog: "IMF Violates IMF Rules, to Continue Ukraine Bailouts

The IMF, whose bailout operations are absorbed by the taxpayers in the member countries whenever a particular bailed-out nation defaults, announced on Friday, June 19th, that it will “continue to support Ukraine through its Lending-into-Arrears Policy even in the event that a negotiated agreement with creditors in line with the program cannot be reached in a timely manner.” Though this new “Lending-into-Arrears” policy violates two IMF rules, it was justified by the IMF’s Managing Director Christine Lagarde on the basis of the Ukrainian government’s “continued efforts to reach a collaborative agreement with all creditors.”

1: The IMF does not lend to nations at war — but Ukraine continues being at war against its former Donbass region despite the Minsk II ceasefire agreement; ceasefire violations, especially by the Ukrainian side, continue regularly.

2: The IMF does not lend to nations that are likely to default — but every independent source categorizes Ukraine as being virtually certain to default, and the only actual question regarding Ukraine is: when? The IMF’s answer: we’ll keep lending, building Ukraine’s public debt even higher, until our aim is achieved, and then we won’t — and that’s when the default will occur — the default will happen when we decide it will happen. It will happen when we will stop lying and saying that it won’t happen.

Consequently, the IMF’s rules are highly flexible. Those rules actually became even more flexible soon after the U.S. Administration of President Barack Obama succeeded at overthrowing in February 2014 Ukraine’s President Viktor Yanukovych. On 23 June 2014, Brett House at QZ headlined, “A great new way for the IMF to help debt-laden countries without forcing them to default,” and he reported that, “The International Monetary Fund (IMF) is considering a big shift in its lending rules.” it would permit the IMF to allow “reprofiling instead of restructuring” for countries that the IMF is determined to keep going. “Creditors would be asked to defer or ‘reprofile’ their debt-service payments for a number of years, in the expectation that the country’s adjustment program would enable it to return to growth and pick up these payments at a later date.””

BBC: "A Greek minister has said new proposals will be put to creditors ahead of an emergency EU summit planned for Monday.

The European Commission, the IMF and the ECB are unwilling to unlock bailout funds until Greece agrees to reforms.”

NYTimes - Paul Krugman: "As many of us have noted, it’s hugely unfair when people claim that Greece has done nothing to adjust. On the contrary, it has imposed incredibly harsh austerity and substantial reforms on other fronts.

Greece is, by this measure, the most fiscally responsible, indeed crazily austere, nation in Europe.”

Yanis Varoufakis: "That Greece needs to adjust there is no doubt. The question, however, is not how much adjustment Greece needs to make. It is, rather, what kind of adjustment. If by ‘adjustment’ we mean fiscal consolidation, wage and pension cuts, and tax rate increases, it is clear we have done more of that than any other country in peacetime.”

Καλή επιτυχία.