Boeckler: "The study finds that the ECB may well stand out positively when compared to other important euro or national authorities involved in managing the euro crisis but that in general the bank did "too little, too late" to prevent the euro area from slipping into recession and protracted stagnation, ending up in its current predicament. The study also finds that expectations regarding the ECB's latest policy initiatives may be excessively optimistic and that proposals featuring the ECB as the euro's savior through even more radical employment of its balance sheet are misplaced hopes. Ultimately the euro's travails can only be ended and the euro crisis resolved by shifting the emphasis towards fiscal policy, by partnering up the ECB with a "Euro Treasury" as a vehicle for the central funding of public investment through common euro treasury debt securities in particular.”

Rapport: "Conclusion and policy recommendations

Contrary to official propaganda, the euro is far from being a success story. The euro area’s performance during its first 10 years was unimpressive, marred with severe divergences and soaring imbalances that remained unaddressed until they unraveled under acute crisis conditions; as they eventually would. Matters got only worse thereafter. Economic performance since 2008 has been outright dismal. By the end of 2014 domestic demand was still some five percent below its 2008 level and HICP inflation entered negative territory. Among the key global players the euro area is the by far worst performer, threatening to undermine the global recovery by its surging current account surplus and plunging currency.

We emphasized that the ECB is a most peculiar central bank. It was modeled after the German Bundesbank and inspired by the “narrow central bank” vision of the Maastricht Treaty. The ECB was granted exclusive responsibility for monetary policy but it was not meant to be much of a bankers’ bank and a government bank not at all. In fact, there was supposed to be a water-tight separation between fiscal and monetary policies in the monetary union. And the ECB was also only granted an ancillary role in financial stability policy beyond the euro payment system. Ultimately this policy structure also stems from the fact that Europe’s currency union is not a fiscal union; the euro lacks a federal fiscal capacity.

As it turned out the legal constraints and uncertainties rooted in this highly abnormal policy structure have also come to hinder the ECB’s conduct of monetary policy and capability to act as lender of last resort in crisis.

Recent developments in Greece provided an urgent wakeup call. Muddling through is becoming more and more risky. At some point dismantling the euro may be perceived as the less damaging option or euro exit/breakup result by accident.”

Maar, eerlijk gezegd, het lijkt mij geen goed idee om een ECB te hebben in een fiscale unie met federale fiscale bevoegdheden. Zeker niet als die ECB onafhankelijk is, enkel gebonden is aan een monetair beleid en totaal niet afhankelijk is van de nationale politiek. Dat zou betekenen dat geld en banken de overhand hebben in het bepalen van het fiscale beleid, en niet het volk. Het probleem wordt ook duidelijk in de recente verlaging door De Nederlandsche Bank van de rekenrente voor de pensioenfondsen. Daardoor komt de dekkingsgraad van de pensioenfondsen onder druk en zullen de pensioenpremies stijgen en mogelijk ook de pensioenen verlaagd worden. Dat is politiek bedrijven zonder het parlement en het volk te consulteren. Dat is de macht van het geld het beleid laten bepalen.

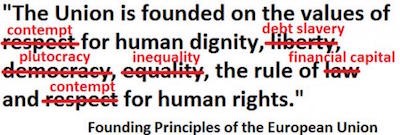

Naast de uitvoerende, de wetgevende en de rechterlijke macht die de basis vormen van onze democratie, bestaat er de facto ook een financiële macht, de nationale banken, die onafhankelijk is van de andere machten. Het handhaven van de prijsstabiliteit is formeel de enige taak van de nationale banken. De ECB moet dus waken over de euro. Ik heb niet de indruk dat dat bijzonder geslaagd is. De ECB waakt in feite over het voortbestaan van de banken. En dat kan inhouden dat de bevolking de armoede in gedreven wordt. Dus is geld de reële vierde macht.